Donald Trump’s tax avoidance was big news before the way he treats women was big news. His supporters say something like, “Don’t hate the player, hate the game.” This is even though Trump’s tax proposals skew the game even more for those already rich.

So let’s take a look at the game as currently played.

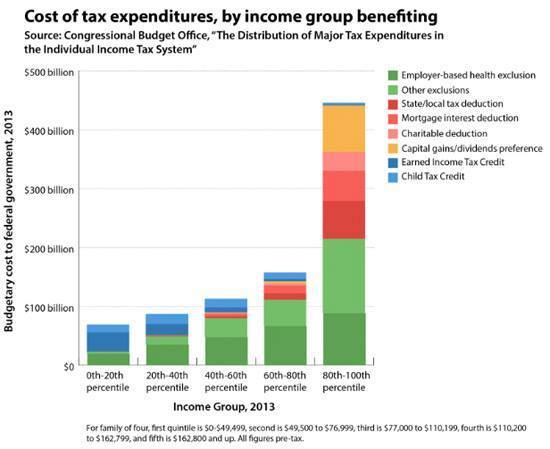

I think this chart was created by Daily Kos based on data from the Congressional Budget Office.

The poor get to benefit from employer-based health insurance, Earned Income Tax Credit, Child Tax Credit, and a little bit of other tax exclusions. The cost to the government is about $65 billion.

The rich get to benefit from employer-based health insurance, state and local tax deductions, mortgage interest deductions, charitable deductions, reduced rates on capital gains and dividends, and a whole lot of various other exclusions. The cost to the government is about $435 billion.

Yup, the tax law game is skewed towards the rich. And Trump’s proposed changes benefit … himself.

A few of the ideas in Hillary Clinton’s plan:

* Cap itemized deductions.

* Add the Warren Buffet rule: Anyone making more than $1 million a year pays at least 30%.

* Add an additional 4% tax on those with incomes over $5 million.

Sunday, October 16, 2016

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment